Akiya Bank Explained: How to Navigate Japan’s Abandoned House Database

Are you dreaming of owning a traditional Japanese house or looking for an affordable housing option in rural Japan? Akiya Bank, a database dedicated to vacant or abandoned homes, might be the resource you’ve been looking for. In recent years, the popularity of akiya has grown due to media coverage highlighting their affordability (CNBC’s “Want a free country house in Japan? They’re giving them away” ) and the pandemic-induced trend of remote work and migration to the countryside. In this series, we will guide you through the Akiya Bank system and how you can utilize it to find your dream home in rural Japan.

Jump to:

・What is Akiya Bank?

In short, Akiya Bank is a publicly operated database that provides information on available vacant or abandoned houses and land, known as “akiya.” Each municipality typically has its own Akiya Bank. Despite the name, it is not actually a bank or a financial institution – the platform’s purpose is to bring more akiya properties into the market and to encourage migration to dwindling neighborhoods.

It is important to note that Akiya Bank’s role is solely to provide property information. While the local government operates the platform, it will not be involved in the real estate transaction and is not responsible for the accuracy or integrity of the information provided. As a potential buyer, you, or the real estate agency appointed by the municipality, will be responsible for conducting due diligence, negotiating with the owner, and drafting contract papers.

While the involvement of a realtor is often optional in akiya transactions, some akiya owners or municipalities mandate the use of one. If a real estate agent mediates the transaction, you will need to pay a certain amount of commission, typically 3% of the property price plus 60,000JPY (the standard amount among all kinds of real estate sales/purchases.) It is also worth noting that when purchasing an Akiya, the buyer is responsible for any necessary repairs or renovations to the property, as they are typically sold as-is.

・Types of Akiya Bank

There are currently three types of Akiya Banks available. Unfortunately, there are no official Akiya Banks provided in English or other non-Japanese languages.

“Local” Akiya Banks

They are operated by each municipality, with 1318 municipalities having set up their own Akiya Bank as of April 2023 (out of 1718 municipalities in Japan.) A list of currently running local Akiya Banks in Japan can be found here. (Please note that the link is only available in Japanese.)

It’s worth noting that each local Akiya Bank is operated independently by its respective municipality. As such, there’s no standardized system or guideline on what types of information should be included or published. As a result, the user experience of browsing these Akiya Banks, as well as the quality and quantity of property information provided and how updated they are, can vary significantly between municipalities.

“Regional” Akiya Banks

In addition to the local and national Akiya Banks, there are also regional Akiya Banks that provide comprehensive information on available properties and akiya-related information within specific prefectures or regions. These websites are typically managed by the local realtor associations or government bodies. For instance, the Shizuoka prefectural government operates a website where all available akiya properties within Shizuoka can be found. Another example is the Nagano Real Estate Brokerage Association, which operates a regional Akiya Bank listing 627 properties in Nagano. By utilizing these resources, you can further narrow down your search for your ideal akiya property based on specific locations and preferences.

“National” Akiya Banks

Two major real estate portals, HOMES and At Home, operate a national Akiya Bank under the appointment of the national government. These national Akiya Banks consolidate property information from the individually operated local Akiya Banks across Japan to allow easier browsing of akiya properties.

HOMES has a slight edge over the competitor, with 737 municipalities listing 6,041 properties as of today. It has a more sophisticated website with easier, more intuitive navigation, but you will need to call or email each municipality directly to inquire about a property, which could be a little cumbersome.

At Home has 5,973 listings by 688 municipalities. Although the website is somewhat basic and harder to navigate, it offers a standardized inquiry form for all listings, making it much easier to inquire about the property.

・Steps to buy an Akiya using Akiya Banks

The following are the typical steps you will follow to buy an akiya using the Akiya Bank. If you are using a mortgage instead of paying cash, some more steps, including pre-approval and underwriting processes, will be added.

1. Search properties:

Use the national Akiya Bank to search for properties in the areas you might want to live in and get an idea of the budget level, unless you already have specific areas in mind (in which case, look for the local or regional Akiya Banks.)

2. Contact & Inquiry:

Once you find a property that might be interesting, contact the municipality listing the property to inquire about availability. Some municipalities accept emails, while some only accept phone calls or faxes.

3. User Registration:

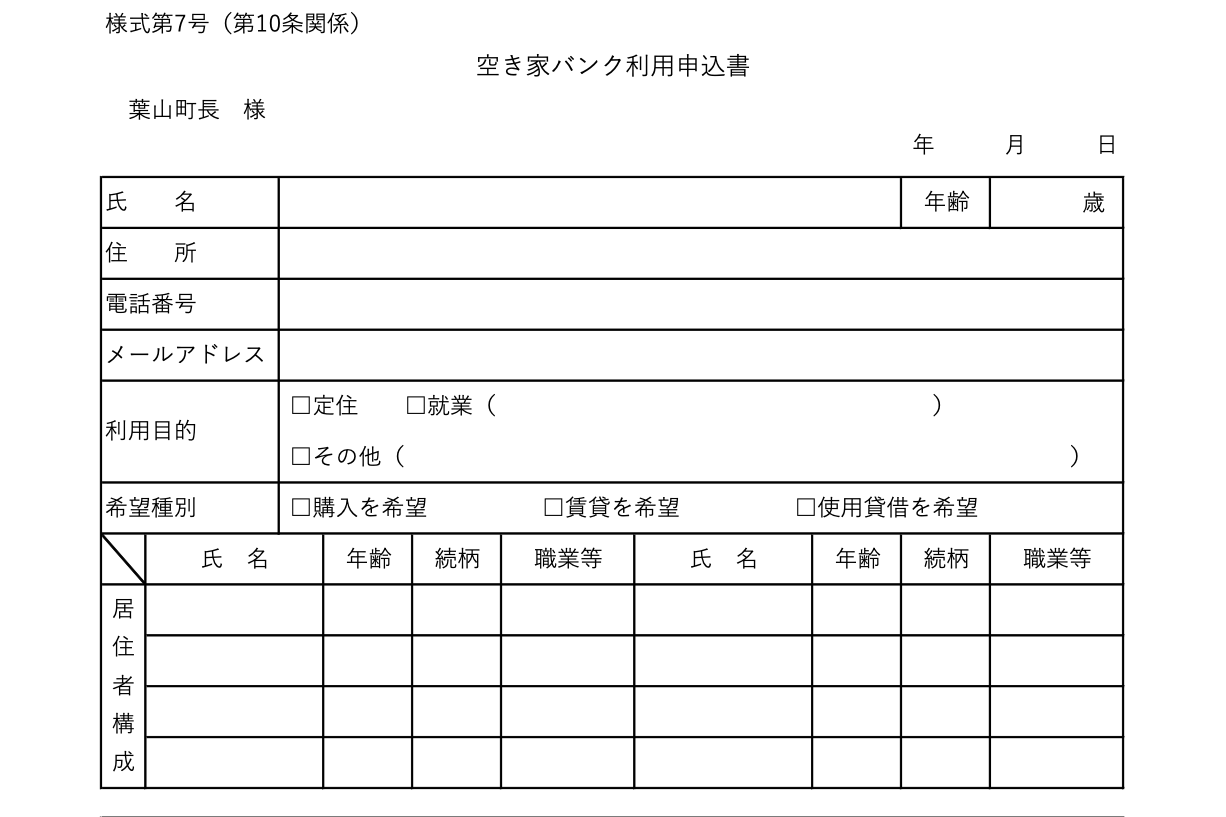

If you decide to move on to the next steps, i.e., visiting the property in person or starting a negotiation with the owner, or if you wish to receive updates when any new criteria-matching property becomes available, you will have to register as a user with the municipality by filling out a registration form. Some of the information you will be requested to provide include:

- You and your family’s names, address, dates of birth, and occupations

- Your phone number and email address

- Why you are looking for a property in that particular area

- Your budget

Most municipalities require the registration form to be physically submitted via mail or fax, while some provide online forms. Also, you may be asked to provide a copy of your ID, such as a passport or driver’s license. Below is an example of Hayama Town (Kanagawa)’s registration form, which can be found here.

Note: Sadly, there is no single unified system to register for all municipalities as of now, meaning that if you are considering multiple properties in several municipalities, you will have to go through the registration process with each of the municipalities by filling out separate registration forms.

4. Tour Request:

Once the municipality has approved your registration, request a property tour and arrange the dates. Before doing so, make sure to ask for any details that may not have been online (such as the exact location of the property, any past records, any potential disputes with neighbors, etc.) so you can learn more about the property in advance of the tour.

4. On-site Tour:

Visit the property in person to inspect if it’s in the condition fit for your use. Make sure to always visit the property before making any commitments.

5. Due Diligence & Negotiation:

Once you’ve seen and liked the property, you might want to conduct a more detailed due diligence before moving on to negotiate with the owner. This is the best time to bring a real estate agent on board, whether they are the one you appointed or the municipality.

7. Contract & Ownership transfer:

Once all the terms and conditions have been set and put in writing, sign the contract and make the transaction official. This will also be the stage where all the payments will be made. An administrative scrivener will register the transfer of property ownership with the Legal Affairs Bureau to preserve your rights.

8. Handover:

CONGRATULATIONS! Get the keys, and the house is finally yours!!

Conclusion

Akiya Banks in Japan can be a useful resource for finding affordable housing options, especially for those interested in purchasing a traditional Japanese house or seeking to live in the countryside. While navigating the platform only provided in Japanese can be challenging for some, it may turn out to be worthwhile in the end if this is the lifestyle you are looking for. It may also be a good idea to hire a professional bilingual help to not only look for a potential match, but also to assist communication and all other processes along the way.

*Information as of May 2023.

Pingback: Pros and Cons of Buying an Akiya Property in Japan: What You Need to Know - EAVES Japan : Blog